5 April 2023 In Blog Post, Morning Commute Blog

Finance on Track: Accelerating Decarbonisation of Rail

Financing rail projects will play a crucial role in fostering the move toward sustainable and climate-resilient transport systems and infrastructure. Energy and emissions data have consistently shown that rail transport is the least CO2-intensive motorised mobility whilst providing other benefits to society such as reducing noise, congestion, accidents and environmental pollution, which are currently not captured by pricing of railway operations.

Rail is a relatively capital-intensive investment, with a long period for a return on investment, this can make it difficult to attract long-term financing for large infrastructure projects. This comes in addition to the need for infrastructure renewal, upgrading of digital systems and quality of service for ever-evolving travel needs and preferences.

In the past decade, rail is the only mode of transport to reduce emissions through a continual programme of electrification, combined with substantial energy efficiency gains through technologies such as eco-driving and regenerative braking. A train trip from Paris to Lyon – on the oldest rail line in France – emits about 24% of the CO2 emissions of an equivalent flight.

The electrified Ethio-Djibouti Railway allows exports to reach foreign markets faster and at a fraction of the cost of road freight, benefitting from domestic hydroelectric renewable energy, which ensures reliable and low-emission operations. The line carries over 2 million tonnes of freight per year, including the important economic export of coffee. Each of the 1,900 freight trains operated replaces 53 lorries, which equates to savings of 144,000 tonnes of CO2 emissions annually and reductions of other important externalities associated with road transport.

The role of Multilateral Development Banks

Multilateral Development Banks, or MDBs, have a key role to play in helping to bridge this investment gap. As many of the MDBs have set targets to invest in positive climate impacts, with the most ambitious ones looking at reaching 100% of their portfolios being Paris-aligned this year, investing in rail is of growing interest. Rail is increasingly considered to be a low risk and Paris agreement aligned investment for banks (especially for electrified lines).

These banks can help de-risk investment, especially due to the volume and timeframe of rail projects. They can provide technical advisory, broker investments, and serve as guarantors of projects and as financiers. They offer strong market signals that can elevate private investment participation in the project, and are well positioned to lead blended finance projects, where grants from other institutions can be brought into the investment pool. Examples include:

- European Investment Bank: The Green Rail Investment Platform offers lending, blending and advisory services of the European Investment Bank with EU financial instruments, to address specific market needs, explore new business models and boost opportunities to finance innovation and advance climate action in rail transport across the European Union.

- World Bank: A USD 400 million development financing agreement will enhance rail freight transport in one of Egypt’s most important railway corridors (Alexandria–6th of October–Greater Cairo Area). The World Bank estimates that the project will reduce GHG emissions by 965,000 tons over 30 years. It will also improve the railway sector’s performance and promote private sector participation by creating Egypt’s Infrastructure Access Charging regime.

Why is reporting important?

Project bankability is still a priority for investment decision-making but expanding the views on the priority impacts to include Environmental, Social and Governance elements is the game changer, especially for the rail sector. And to show ESG credentials of rail projects, robust reporting tools and frameworks are fundamental.

To support companies in assessing, benchmarking and making visible their sustainability performance, the International Union of Railways (UIC) launched in 2022 the Rail Sustainability Index (RSi). With Key Performance Indicators developed to track rail companies’ performance against 7 UN SDGs, the first data collection results show that more than 290GWh of energy were saved over the last 3 years among the RSi reporting companies. Companies achieved savings through a range of initiatives and technologies such as modern heating and lighting systems, regenerative braking and eco-driving techniques. This saving is the equivalent to the annual electricity use of almost 40 thousand households1.

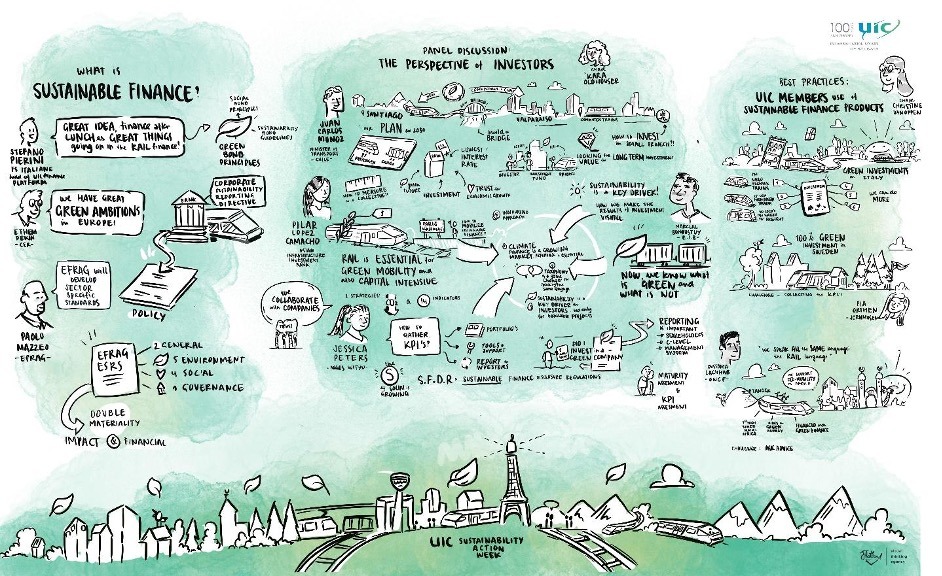

There is significant progress in decarbonising the rail sector and a greater need to translate progress into further bankable projects. The links between quality reporting and access to climate financing was a key topic in the recent Sustainable Finance Workshop held by UIC. The importance of instruments like the EU Taxonomy in creating a common language and its practical applications to rail companies were explored and can be seen in the summary illustration of the event.

How are railways benefitting from sustainable finance?

The Moroccan National Railway Company (ONCF) is benefitting from green bonds launched in July 2022, the first of its kind for the infrastructure sector in Morocco, and the first in the mobility sector in Africa. Thanks to this issuance, the company was given financial capacity to attract further investments, and, for the first time an international investor, the European Bank for Reconstruction and Development. It will allow ONCF to continue carrying out its green transformation by switching 25% of its overall energy consumption to green energy, to reach 50% in 2023 before increasing 100% in the medium term. The green bonds, equivalent to EUR 95 million, are aligned with the Low Carbon Land Transport Criteria of the Climate Bonds Standard.

Another example of sustainable finance impact in railway is Jernhusen, a Swedish real estate company. The company owns, develops and manages the main railway stations, maintenance depots and freight terminals along the Swedish railway network. The real estate management contributes to the attractiveness and efficiency of the Swedish railway network. Jernhusen is now committed to reaching climate neutrality by 2045 and has recently launched a new framework for new green financing. Combining certification programs with energy efficiency requirements that are evaluated by third parties, it is an example of cooperation between finance and sustainability creating a virtuous cycle for investments in railway related infrastructure.

A rapidly changing climate requires all governments, businesses and individuals to respond efficiently and responsibly. Rail companies are working to reduce CO2 emissions, while delivering on SDGs wherever possible and improving ESG reporting to match requirements for financing new operations and infrastructure. Financial institutions must support rail development by addressing specific market needs, exploring viable business models and boosting financing of rail transport. Failure to support rail as a low-emissions solution to high volume transport can jeopardise efforts made in the last decade and policies and targets to promote the green mobility transition by 2050.

—

1 US EPA’s Greenhouse Gas Equivalencies Calculator: https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator

Lucie Anderton

As Head of Sustainability at the International Union of Railways (UIC), Lucie leads the Environmental technical topics as well as global advocacy for rail as a climate solution. UIC is the global association of railway organisations. On secondment from Network Rail, the UK Rail Infrastructure manger, Lucie has 18 years of experience in sustainability policy and environmental management in the rail industry and major infrastructure projects.

Joo Hyun Ha

Joo Hyun Ha is a senior sustainability advisor at UIC, building partnerships and advocating for the role of rail in sustainable mobility systems. Her expertise includes environmental policy, with a focus on built environment, transport and cities, as well as in international cooperation from previous roles at UNEP Cities Unit and at the Sao Paulo City Hall.

Lucie Anderton

As Head of Sustainability at the International Union of Railways (UIC), Lucie leads the Environmental technical topics as well as global advocacy for rail as a climate solution. UIC is the global association of railway organisations. On secondment from Network Rail, the UK Rail Infrastructure manger, Lucie has 18 years of experience in sustainability policy and environmental management in the rail industry and major infrastructure projects.

Joo Hyun Ha

Joo Hyun Ha is a senior sustainability advisor at UIC, building partnerships and advocating for the role of rail in sustainable mobility systems. Her expertise includes environmental policy, with a focus on built environment, transport and cities, as well as in international cooperation from previous roles at UNEP Cities Unit and at the Sao Paulo City Hall.