OECD Investment in Inland Transport Infrastructure at Record Low

A recent update by the International Transport Forum on investment and maintenance expenditure on transport infrastructure for 1995-2013 shows that continued economic crisis has had an impact on transport infrastructure investment in OECD countries. The data is based on a survey sent to 54 ITF member countries (at the time of the data collection), which covers total gross investment (i.e. new construction, extensions, reconstruction, renewal and major repair) in road, rail, inland waterways, maritime ports and airports, from all sources of financing.

The July 2015 update of annual transport infrastructure investment and maintenance data collected by the International Transport Forum at the OECD offers three main take-aways:

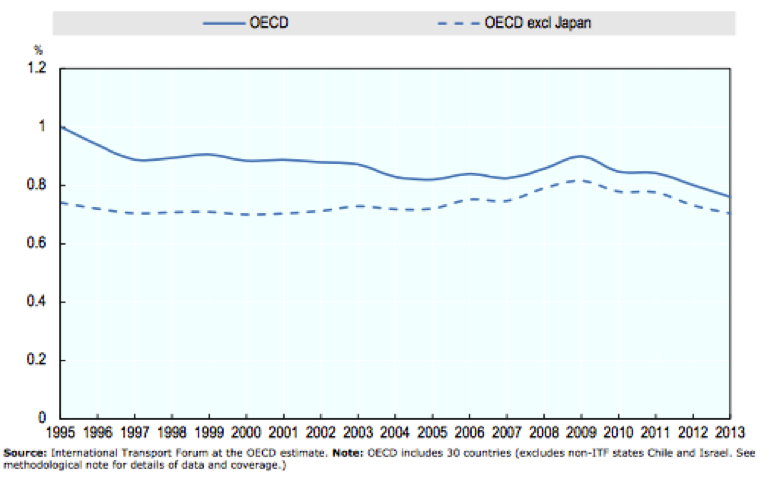

- Investment in inland transport infrastructure, as a share of GDP, has declined from a peak in 2009 to a record low (0.8%) in OECD countries (see Figure 1) while total volume of investment has fallen back to 1995 levels (see Figure 2).

- Investment levels in Central and Eastern European countries have nearly halved since 2009 in real terms, accounting for 1% of GDP in 2013 (compared with 1.9% in 2009).

- Western European and North American economies continue to invest increasingly in rail, while in Central and Eastern European countries the focus continues to be on roads.

Part of the decline can be contributed to Japan (whose economy is large enough to affect the overall average), which followed a different trajectory from the rest of the OECD before 2007 due to general budget cuts towards the end of the 1990s. However, the most recent data suggest that the continued economic crisis has resulted in a broader decline in transport infrastructure spending, measured in real terms, across many OECD countries, as seen in Figure 1.

Figure 1. Investment in inland transport infrastructure in OECD 1995-2013 (as a percentage of GDP, at current prices)

Figure 1. Investment in inland transport infrastructure in OECD 1995-2013 (as a percentage of GDP, at current prices)

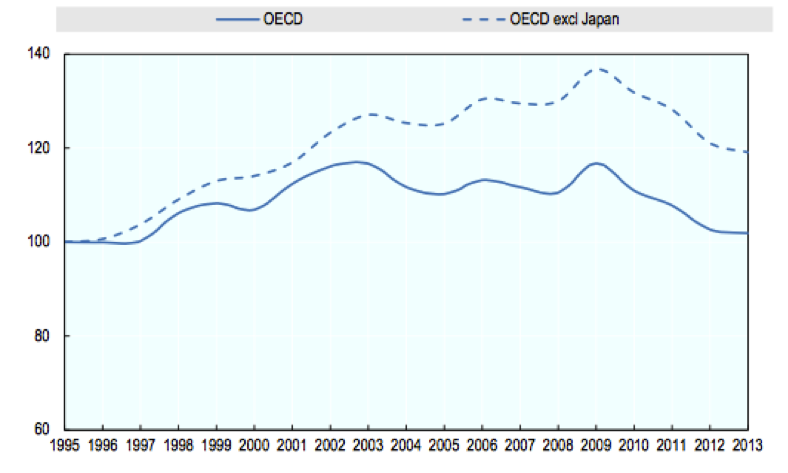

The volume of investment (expenditure in real terms) in the OECD as a whole grew 16% from 1995 to 2002 after which it remained relatively stable until 2009. This trend was temporarily interrupted by stimulus spending in 2009 (as seen in Figure 2), but recent data show volume falling back to 1995 levels.

Figure 2. Volume of investment in inland transport infrastructure 1995-2013 (at constant 2005 prices, 1995=100)

In slight contrast to the average trend is the Russian Federation, where the investment share of GDP has been high compared with Western European and North American countries but volatile throughout the period. In addition, the data for India since 2005 shows the volume of investment in road and rail infrastructure has doubled over the period; however, due to faster growth in GDP than in land transport investment, the GDP share of transport investment has declined from 1% in 2006 to 0.8% in 2013.

The fact that the share of GDP dedicated to transport infrastructure has tended to remain constant (and more recently decline) in many countries suggests that investment levels are affected by factors other than real investment needs, such as budget allocation procedures, budgetary constraints, and government policies. For example, the share of inland infrastructure investment in GDP has remained relatively high (above 1.0%) in Australia and Canada, partly as a result of long-term political commitments to transport infrastructure spending.

In contrast to current OECD transport investment trends, the International Energy Agency (IEA) projects that non-OECD regions will account for nearly 90% of global travel increases over the next 40 years. A further study by SLoCaT states that of estimated total current annual investments in transport infrastructure, 60% is represented by OECD countries and 40% by non-OECD countries, the latter being generally fast growing and developing economies. In future, even if adequate global finance is available, about 85% would need to be directed towards the fast growing non-OECD nations, with 15% to the OECD nations, to meet development needs and curb growth in motorization.

SLoCaT suggests that since the majority of transport asset creation will shift to non-OECD countries, it will be necessary to increase allocation to transport as a share of GDP to accommodate rising transport demand. As the nature of mobility is changing, transport investment requirements are changing in turn; thus, it is more important than ever to invest rightly in transport, rather than simply to invest more in transport.

The full ITF analysis on OECD transport infrastructure investments can be found here.